A savings account is a deposit account held at a bank or credit union that provides a modest rate of interest. Not Like a checking account, which is designed primarily for frequent transactions, a savings account is intended as a place to economize. These accounts are often insured by the federal authorities, making them one of the safest places to maintain your funds. Your funds are nonetheless typically accessible in a personal financial savings account. That means they’ll work for each short- and medium-term savings targets, like buying a automobile or constructing an emergency fund. Nevertheless, some banks may limit the variety of withdrawals and transfers you can make per thirty days.

- Some money market accounts additionally come with debit playing cards or paper checks to access funds in the account.

- As A End Result Of they’re really easy to make use of, they’re typically the primary kind of account many individuals ever have.

- Longer phrases can supply better charges, but you’ll wait longer to tap into your savings.

Objective: Invest Cash For A Set Time Period To Earn Interest

Whether you’re looking to save for the longer term, handle day by day expenses, or make investments correctly, choosing the proper kind of checking account can considerably impression your monetary journey. With banks offering a spread of options tailor-made to numerous wants, navigating via these decisions with clarity can empower you to make informed selections. This complete guide explores the principle types of financial institution accounts, highlighting their unique features and benefits, and serving to you establish which one aligns greatest with your monetary targets. The proper type of checking account for you will depend on what you have to do with your cash. From saving money with a savings account to needing access to liquidity with a checking or money market account, there are plenty of choices on your wants. No matter what kind of checking account you choose, look for an FDIC-insured financial institution and an account with as few charges as possible.

To ship or receive cash with Zelle® each parties should have an eligible checking or savings account. For the safety of your account, Zelle® should only be used to send cash to these you realize and trust. That means your money will not be as accessible as it will be in a traditional savings or checking account.

Get extra from a customized relationship offering no on a daily basis banking fees, priority service from a dedicated staff and special perks and advantages. Join with a Chase Non-public Shopper Banker at your nearest Chase department to study eligibility requirements and all out there benefits. With Chase for Business you’ll receive guidance from a group of enterprise professionals who specialize in helping enhance cash move, providing credit solutions, and managing payroll.

Which Kind Of Checking Account Do You Need?

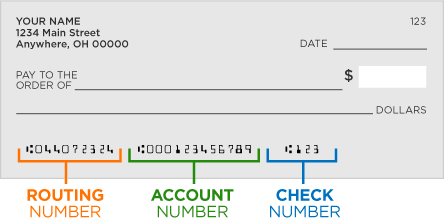

In addition, it’s attainable to switch money to and from a checking account by linking another kind of bank account, such as a savings account. When opening a new account, the financial institution might issue you a debit card or a guide of paper checks that might be used for making purchases. Once the CD matures, you’ll be able to both withdraw your preliminary deposit along with curiosity earned or roll the entire amount over to a new CD. Banks may offer CDs with terms as brief as 28 days or so long as 10 years or more. As far as savings choices go, CDs could be good for cash you don’t think you’ll want right away, however they may be a poor choice for emergency funds. If you need cash from this account at one level, you’ll have the ability to withdraw it.

Then, work towards other financial savings targets with the account that most intently fits your needs. These are the incentives you need to look for when choosing a checking account for personal use. NerdWallet has give you a listing of some of the best free checking account options in 2016. As lengthy as rates of interest remain high, these high-yield accounts will likely remain well-liked. Little famous that everybody from new college graduates to more prosperous, skilled professionals can benefit from a HYSA. He additionally discovered that these accounts educate younger individuals the significance of saving sensibly and making essentially the most of their money.

These manufacturers compensate us to promote their products in adverts throughout our website. This compensation may impression how and where merchandise seem on this website. We usually are not a comparison-tool and these presents don’t symbolize all available deposit, funding, mortgage or credit products. Moreover, these accounts typically include minimal charges and provide simple integration with other monetary https://www.simple-accounting.org/ products. In change for a wholesome APY, you may want to maintain a high minimal stability, sign up for direct deposit or make a sure variety of minimal transactions.

How We Make Money

You additionally might be charged charges if you fail to satisfy account necessities. Brokerage accounts permit you to invest in all kinds of investments with none of the contribution limits and withdrawal penalties that can plague different forms of accounts. These accounts play a critical role when planning a long-term financial technique, particularly for retirement planning. A CD is an efficient way to earn cash because of its higher rates of interest. Nonetheless, you shouldn’t put money into a CD if you’ll need the money before the end of the term. It is feasible to withdraw your cash early,, but you’ll pay a penalty.

Some allow nearly anybody to affix, but provided that they make a donation to charitable organizations. Closing a checking account is, typically, carried out utilizing the identical course of at most banks. It requires a request to close the account and a switch of funds to a special account. However it always helps to ensure you’ve received all of your bases covered. This is the greatest choice for the shopper who really needs to save this cash in addition to get some interest on it. Working with an adviser could include potential downsides, corresponding to cost of fees (which will reduce returns).

Financial Institution deposit accounts, corresponding to checking and savings, could also be subject to approval. Deposit products and related companies are supplied by JPMorgan Chase Bank, N.A. Member FDIC. Choosing financial institution accounts that fit your particular person wants may assist you to to higher meet your private monetary goals. Checking accounts are designed for on an everyday basis use and common financial wants. Money market accounts and CDs may be ideal when improving financial savings is a priority.